Investment

Objective:

Our objective is to excel in a world where financial markets are more global than ever before. Today, money flows more freely between countries and asset classes and always goes where it is treated best. Because of money’s fluid nature within the financial markets, portfolios should be flexible and adaptive in order to keep pace.

Investment Philosophy

Since the performance of stock groups and sectors vary over time, we believe it’s better to buy and rotate into these better performing investments. We are agnostic about where to invest in the financial markets and this allows us to look for opportunities across the broad universe of investable assets. Our clients understand that when the facts change we change, in order to maximize our ability to remain on the correct side of the ever-changing economic climate.

Strategy

We consider the ability to invest in any particular investment item or economic sector to be the greatest advantage clients can have when hiring us to manage their money. We believe that investment management means something different than what the greater Wall Street community considers it to be.

They use methods commonly known as “The Pie”, “Buy & Hold” and “Indexing.” Instead, we offer dynamic portfolio management according to the philosophy and process described above.

Think of it this way, fruits and vegetables come in and out of season at the grocery store. In like manner, the various investment groups and sectors move in and out of season as the economic cycle moves along. Our goal is to identify the investments with the potential to outperform and avoid those with the potential to underperform. This means we buy and rotate to take advantage of changing leadership; most of which last months, sometimes years.

We manage client portfolios by allowing investments to be made in Stocks, Bonds, Commodities, International Markets, Currencies, and Cash. Generally, we utilize ETFs (Exchange Traded Funds) to implement our strategy. The universe of ETFs continues to grow in sophistication such that they allow for the easy ownership of these asset classes.

Risk Management

To quote investor Warren Buffet: “The first rule of investing is don’t lose money; the second rule is don’t forget Rule #1.” This statement reinforces the fact that preservation of wealth remains the number one priority for most investors. Many investors’ greatest fear is that as they approach retirement, investment losses will delay their ability to retire or will impact their standard of living. But, what events most negatively impact an individuals’ preservation of wealth? The most significant risks occur during bear markets.

Most investors will concede that a difficult part of managing an investment portfolio is identifying the formation of a major market top before it is too late, such as occurred in October 2007. This is undoubtedly due to the universal enthusiasm for stocks, and the generally positive economic news that dominates at such times.

The period leading up to a major market top can be likened to the transition from autumn to winter. In autumn the leaves begin to fall very gradually. At first, leaves begin to fall one at a time and almost without notice, until the trees are eventually bare at the onset of winter. It is no different with the stock market; individual stocks begin to roll over into their own Bear markets one at a time. This transition usually begins with small and mid-cap stocks until eventually the large stocks are impacted too. The warning signs of this gradual erosion are present for those willing and able to see them.

It is easy to look at history and identify when bull and bear markets occurred. Nonetheless, it is very difficult to look forward in real-time and identify when a bull market transitions into a bear market. It is not surprising that a large number of studies and work focus on how to generate the highest returns, but what tools does an investor have to guard against significant losses in a bear market? It is important to take a step back and remember that the stock market is driven by the interaction between Buyers and Sellers. As a bull market approaches maturity buying enthusiasm begins to fade and the desire to sell begins to expand.

Understanding the forces of Supply and Demand is a critical component in evaluating the stock market and the gradual erosion that appears in advance of bear markets. As the major market price indexes such as the S&P 500 or Dow Jones Industrial Average continue to move to new highs, most investors are unaware of the actions of Buyers and Sellers as prices become extended and subtle signs of weakness begin to appear.

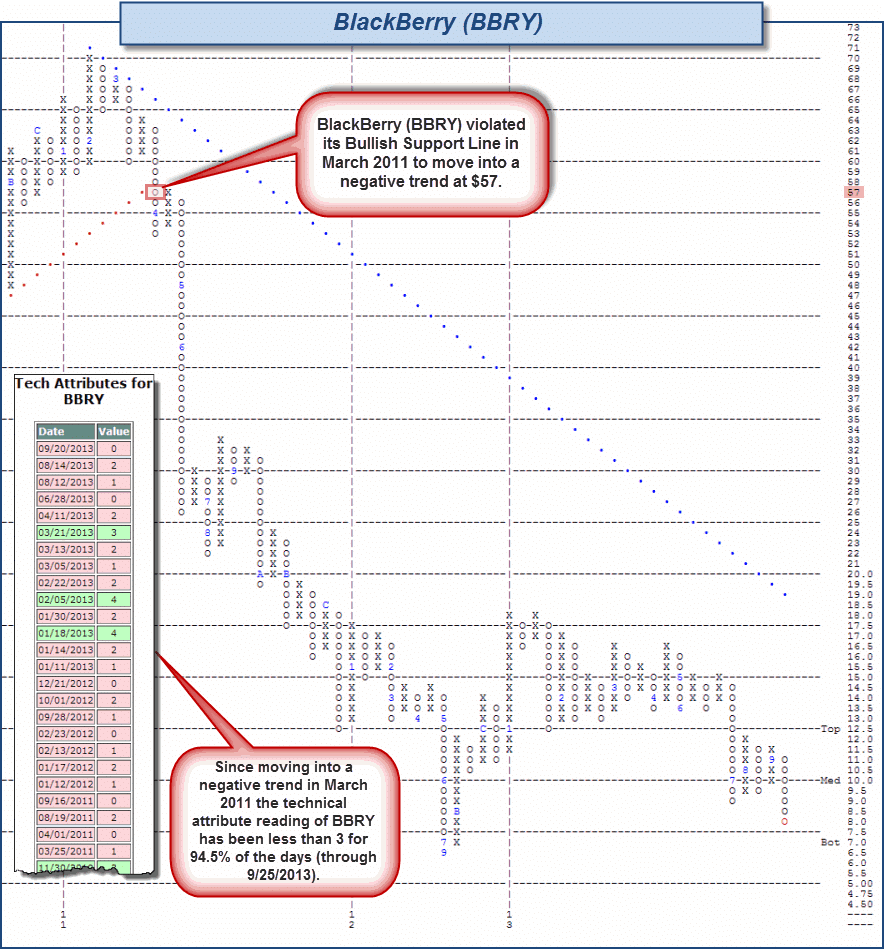

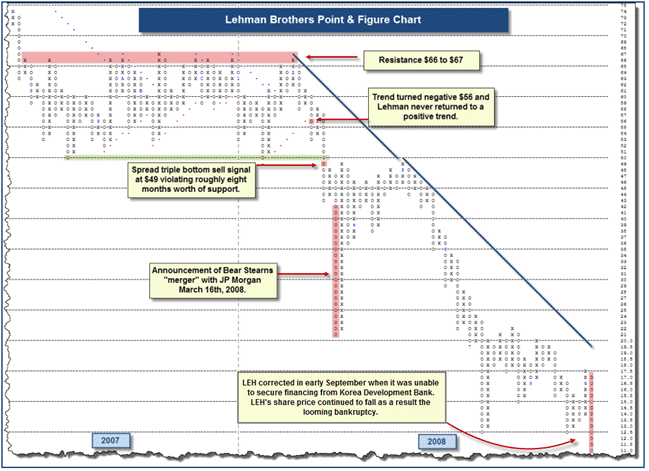

At “LWS”, one of several tools we employ to measure the forces of Supply and Demand is the Point and Figure Chart (see Addendum A and B). While company fundamentals may influence investors to buy or sell an individual stock, it is difficult to identify, out of thousands of other possibilities, what predominant factors are influencing millions of investors to fuel an entire bull market. But the Law of Supply and Demand infers that the reason why investors buy or sell is unimportant. It is the dominance of buyers over sellers or sellers over buyers, which is vital to determining the trends of the stock market. Therefore, it is important to conduct a top down analysis of the composite activities of buyers vs. sellers and measure the resultant forces of Supply and Demand. The study of Supply versus Demand is, therefore, at the core of our investment process for when it is time to buy and for when it is time to sell.

Addendum A:

Addendum B: