At the end of the year Barron’s Magazine gathers the opinions of well-known mutual fund managers to gather their economic/stock market forecast for the upcoming year. The forecast for 2015 called for the following: GDP growth of 3-3.5%, profit growth of 8-10%, a 10yr bond yield of 3%, and the S&P 500 at 2275. For 2015, GDP growth is actually tracking 1.5-2%, profit growth is tracking a negative 5-10%, the 10 year bond yield is 2.1%, and the S&P 500 is at 2010 as I write this.

What these forecasters missed and still don’t seem to understand is the combined risk of deflation and a late cycle slowdown as indicated by the following:

- Commodities (CRB Index) crashed to -24%

- Oil (WTI) crashed to -41%

- Nickel crashed to -44%

- Copper deflated to -25%

- Coffee prices crashed to -32%

- Natural gas prices crashed to -44%

- Emerging Market stocks (EEM) deflated -18%

- Latin American stocks (MSCI) deflated -29%

- Small cap stocks (Russell 2000) are -7%

- Energy stocks (XLE) are -23%

- Large company stocks (S&P 500) are -2.5%

- Dow Jones Transportation Index is -17%

- China stocks (Hang Seng) is -9%

- India stocks (EPI) is -14%

For 2016 the Barron’s Forecasts are calling for GDP growth of +2.5-2.75%, profit growth of +5%, a 10 yr. bond yield of 2.75%, and 2220 for the S&P 500. It’s not too much different from the 2015 forecast. What will the forecasters and the media get wrong this time? What you may not know is that if the data continues to trend bearish (and we believe it will) on both growth and inflation, we’ll see both the slowest year-over-year GDP and corporate profit growth of the cycle sometime in the first half of 2016. In fact, I believe a recession commencing by mid-2016 is increasingly probable.

Our negative view of stocks, commodities, and junk bonds is contrary to the view held by the overwhelming majority of investors, Wall Street, and policymakers. Our view is further reinforced when we analyze the expanding deterioration of stocks taking place beneath the surface. This deterioration is masked by the price performance of the S&P 500 which contains a select few large company names propping it up. They’re known as the “FANG” stocks: Facebook, Amazon, Netflix, and Google. These names and a handful of others have been giving investors a false sense of security. According to Lowry Research the percentage of S&P 500 stocks that are down 20% of more from their 52 week high is rising and is now at 26%. As of November 3rd it was 23%. The deterioration among small company stocks is even more worrisome at 57% being down 20% or more. Extreme caution is warranted.

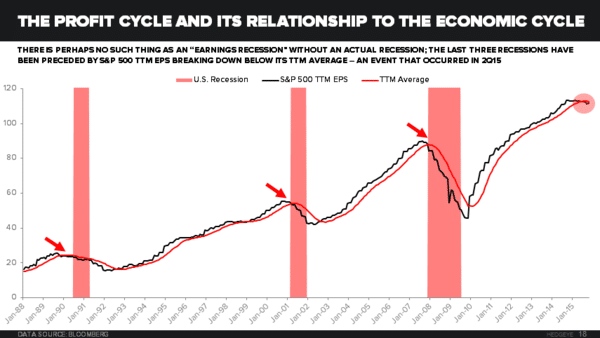

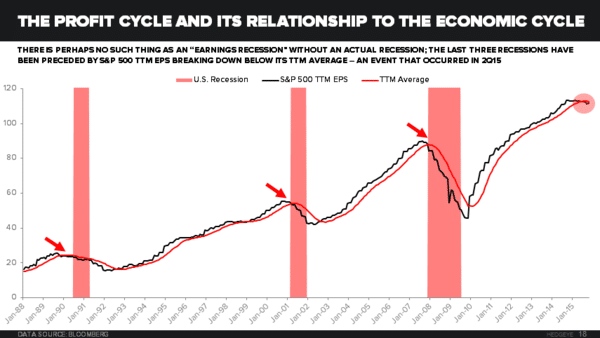

There is an intimate relationship between corporate profit growth and the economic cycle and this relationship seems to have caused a major buyer of stocks to step aside in the third quarter of 2015. Profits of non-financial corporations declined 5% vs. the third quarter of 2014 however their debt level increased 7% vs. the third quarter of 2014. This large gap between debt growth and profit growth is the widest since 2007 and it caused less cash to be available for corporate share buyback programs. And as a reminder let me just say that bad things happen when debt grows faster than profits. And to confirm this information, the Federal Reserve released data showing that there was a 75% DECLINE in company share buybacks in the third quarter of 2015–no doubt a contributing factor in the stock market downdraft in the third quarter. If I had to guess, I’d say that in addition to deflation and growth slowing, another key theme for 2016 will also be that contracting corporate profits will equal weaker cash flows and therefore a much lower level of corporate share buybacks.

While I have not gotten every market move right, specifically the timing of our short positions, the factor exposures we did adopt as a result of our research and technical analysis has kept us away from all of the aforementioned asset groups that continue to crash or perform poorly. We will continue to monitor stocks, bonds, commodities, and currencies for signs of either an economic turnaround or further deterioration. However, I seriously doubt the central planners of the world will be able to bend economic gravity and prevent a good old fashioned bear market.

After all, the Federal Reserve has NEVER proactively predicted a recession. Remember, policy makers and Wall Street will forever cheerlead for rising stock prices. They will ALWAYS have a story to tell that supports their interests. They’re very good at it, actually. But sometimes the lies and misinformation can be deafening. On the other hand, clients and I can’t afford to ignore the economic cycle for what it really is. By paying keen attention to the cycle we won’t blow up our wealth every time there is a late cycle slowdown in the economy. Instead, I hope to achieve the opposite.

I have over 25 years of experience doing financial planning and risk managing investments, and in particular 401k plans at work. If you’re not happy and would like to have a conversation, call me at (914) 761-3237.