By now, I’m sure you have noticed how the cost of almost everything is rising: housing, food, rent, energy, lumber, gasoline, copper, meat, insurance, corn…even burlap and tallow…almost everything is rising. You may also be wondering how all of this inflation suddenly appeared after years of it being fairly benign. It mostly begins with the pandemic. The pandemic caused the shutdown of lumber mills, meat processing plants and a huge shift by the consumer to working from home and buying lots of goods for our homes and also eating at home. This shift to basically doing everything at home caused huge supply chain disruptions and shortages.

Rising inflation is exactly what you get during a Quad 2 economic regime. Quad 2 is when Growth rises and Inflation rises. Our models began forecasting a Quad 2 economic regime back in October 2020. This prompted our investment allocation to tilt into Commodities, Energy, Industrials, Basic Materials, Financials and Small Cap stocks. It’s been a good run. But, we are now at a crossroad. The global pandemic has created price and supply distortions throughout the global economy. The production of food, toilet paper, goods, services, labor, shipping and travel were thrown into disarray as mentioned above. Economists are still trying to figure how growth and inflation will play out as conditions slowly normalize, and I can tell you there are endless theories. As for me and my team, we don’t engage in theories and narratives as most of Wall Street and financial media do. We stick to mathematically tracking the economic data as each piece is released almost every day. We also use calculus inside a technique known as “Base Effects.” Doing this enables our models to be forward looking to help us understand how economic conditions might evolve in the coming months. As each piece of economic data is released, we have an opportunity to “refresh” the models and identify potential changes. Why do we do this? Because, changes in growth or inflation have a direct impact on how different investment items (factor exposures) behave. During a Quad 2 regime for example, Bonds, Gold, Utility and Consumer Staple stocks which are traditionally conservative investments, have negative expected returns: and go down is exactly what they did starting around October 2020. Therefore, as we transition through the various four Quads within our process, our investment allocation will shift. Our goal is to gain exposure to those items with the highest expected return in that particular Quad and to avoid those with negative expected returns. It’s that simple. But, it’s a ton of work.

The title of this note is “Crossroads” because that’s where we are right now. Our models and our Market Signaling tools are saying we are somewhere between Quad 2 and Quad 3. The reason I say this is because the financial markets are struggling with this issue right now. When financial markets are indecisive about what economic regime comes next, they get volatile. Quad 3 is where growth decelerates but inflation continues higher. So, Quad 2 & 3 are both regimes where inflation goes higher. Technically, Quad 3 is stagflation. Why are we somewhere in between? The financial markets are signaling some of Quad 2 and some of Quad 3. Some Quad 3 exposures have stopped going down and are actually starting to rise such as Utilities, Gold and Consumer Staple stocks. Some Quad 2 exposures such as Basic Materials and Small Cap stocks show deterioration. So for the moment our investment approach is to own those exposures that have historically positive expected returns in both Quads. Examples would include Large Caps, Energy, Technology, Industrials and Commodities. I’m certain we’ll gain greater clarity in the days and weeks ahead and as we do, we’ll continue to shift our investment allocation accordingly.

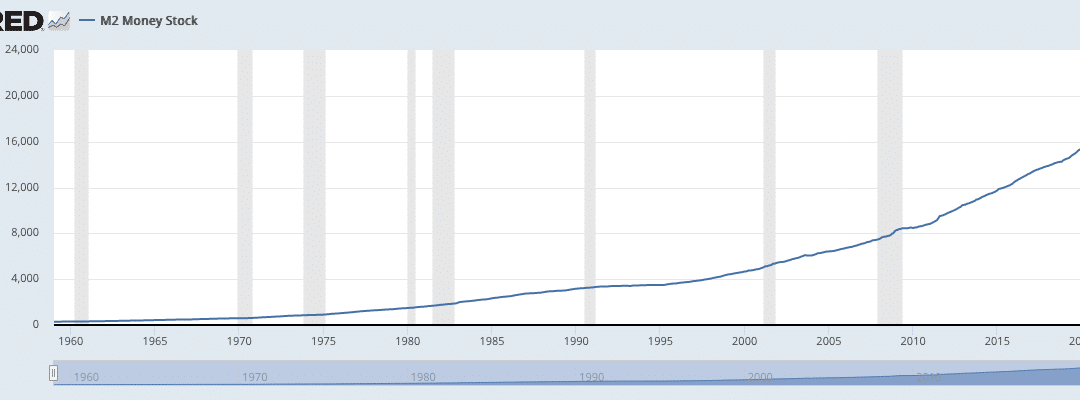

Let’s briefly talk about inflation. As we slice and dice the data and dig deep into the economic distortions mentioned above, we don’t see any signs of inflation abating. The underlying catalyst for inflation continuing to trend into 2022 is the coordinated efforts of the US Government and the Federal Reserve. The US Government keeps spending trillions of dollars and the Federal Reserve creates the cash to pay for it. Their combined efforts have caused the money supply, known as M2, to expand at rates of greater than 20% per year. Historically, when you keep increasing the amount of dollars in circulation (M2), the result is inflation. Currently, we are expanding the money supply during a period that is already suffering price distortions from the pandemic. The Biden administration and Congress have additional spending plans for infrastructure and other items that are somewhere in the $3-7 trillion dollar range. We’ll have to wait and see how the negotiations play out. But, huge government spending at the wrong time can and usually does cause inflation to rise. The June inflation number came in at 5.4%. This is already double the Federal Reserve’s “target” of 2%. Stay tuned and hang onto your pocketbooks.

My most important financial goal for my family is to methodically grow our wealth….and then preserve and protect that wealth as growth and inflation change and also when the inevitable big decline comes. If I thought there was a better investment strategy to accomplish this important goal, I’d be doing it. And, the buy & hold type of strategies I was taught many years ago is definitely not it.

Sincerely,